Optimizing your site and webpages for search is complex enough without the additional regulatory concerns and other challenges inherent to the financial industry.

Digital governance, consumer privacy and trust, information accuracy, and the rapid pace of innovation in the sector are among the going concerns for financial brands.

Whether you’re in insurance, banking, wealth management, mortgages, fintech, or another facet of the financial services industry, there are some additional issues to work into your SEO strategy (on top of general SEO best practices).

In this article, we’ll take a look at some of the key trends that leaders in marketing and SEO need to keep an eye on in the months and years ahead.

You’ll also find proven tips throughout to help improve the efficacy of your efforts to rank higher in search, convert more searchers to customers, and protect your brand while enhancing your online visibility in search.

1. Digital Transformation Is Driving Evolving Customer Needs

Even prior to the onset of the pandemic, Adobe’s 2021 Digital Trends: Financial Services & Insurance in Focus report found that 54% of financial services and insurance firms surveyed had reported unusual growth in digital/mobile visitors in the six months prior to that early 2021 survey.

Then COVID-19 changed everything.

Customers’ informational needs and the ways in which appointments, consultations, transactions, and contracts were handled changed almost overnight as much of the world went into lockdown.

Fintech and the promise of decentralized finance via cryptocurrencies had already shaken up antiquated, paper-based legacy systems and the pandemic accelerated the pace of change by years.

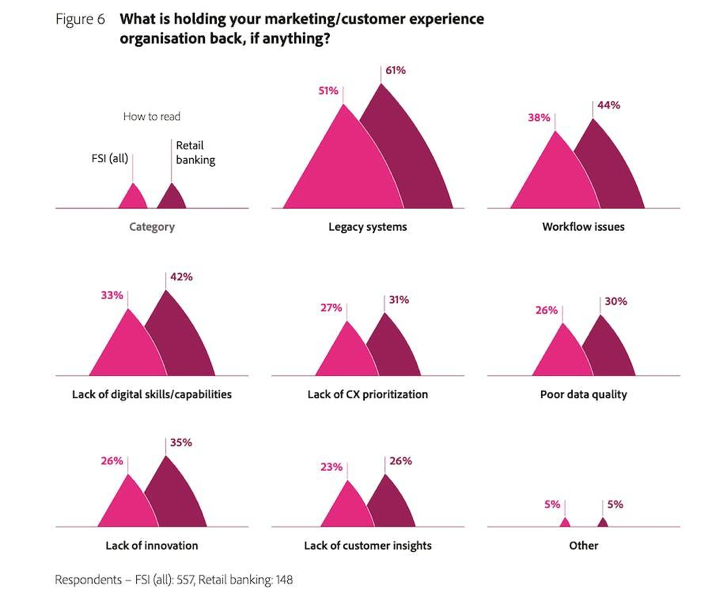

Adobe’s survey also found that 61% of retail banks said legacy systems were a top challenge holding their marketing and customer experience organizations back (followed by workflow issues for 44% and a lack of digital skills/capabilities for 42%).

Screenshot from Econsultancy, January 2022.

Screenshot from Econsultancy, January 2022.Operational costs for fintech brands may be up to 70% lower than traditional banks, thanks to their lean operating models and structures.

Even so, says KPMG’s Anton Ruddenklau, Global Co-Leader – Fintech:

“Before COVID-19, we were already seeing an increase in the corporate venture arms of the large banks actively buying up promising fintechs and start-ups. As we emerge into the recovery and beyond, we can expect this to accelerate.

The incumbent giants are likely to acknowledge that they need a greater degree of scaled collaboration with fintech players to bring more digitized services and benefits to their customers.”

Fintech is not a clear winner in the search space by virtue of its digitized services and benefits; not by a long shot.

We’ve moved beyond all transactions and inquiries taking place in person or over the phone.

Today, financial services customers expect self-serve options at every stage of their journey, from discovery and comparing their options through consultation, transaction, and service.

Brands that are best able to meet these expectations and customers’ increasing informational needs are best-positioned to succeed in search.

How you convey these offerings in organic and local search is key.

Financial brands not only have to create the best experiences but be able to demonstrate to search engines that they are the best answer to relevant queries, as well.

Tips And Takeaways

Leverage Proper Schema Markup For All Webpages

The most commonly used Schema types in banking are Articles, Image Objects, and FAQ.

Though not specific to banking, they help search engines like Google to better understand your content.

Make Sure You Know Who Your Competitors Are

It may not be who you think.

In addition to direct competitors in your space, you may also be competing against industry publications and media, regulatory bodies and other informational sources, local businesses, YouTube channels, podcasts, and more for share of voice in the SERPs.

Conduct Surveys And Analyze Your Seo Data For Customer Insights

Consumer-centric media and ecommerce experiences have raised the bar as far as what consumers expect of content personalization.

They now expect that the technologies they interact with will programmatically learn their preferences and tailor the experience accordingly.

2. Your Opportunities To Appear In The SERPs Are Growing

As Google strives to better understand searcher intent and provide better answers to increasingly complex queries, we’re seeing more differentiation than ever in search engine results pages (SERPs).

Google’s new Multitask Unified Model, or MUM, technology is already in play.

MUM enables Google to better understand content in different languages, formats, and content types.

Now, we’re seeing new results types being tested, such as this enhanced Autocomplete box that adds an extra dimension to the results, depending on what Google perceives the searcher’s intent to be.

Optimizing for Featured Snippets is a best practice that can present valuable opportunities to expand your presence in search.

Structuring and marking up content in specific ways – as a numbered or bulleted list, or table, for example – can help Google understand when your webpage might be a good candidate for a featured snippet.

Research by BrightEdge (disclosure: my company) shows that the SERPs for financial services queries tend to contain a variety of universal listing elements depending on the type of query.

We’ve seen that higher-funnel, “I-Want-To-Know” queries like [best investment apps] and [how to invest] bring back Quick answers boxes and People Also Ask dropdowns, for example.

Understanding which SERP features are available by keyword and search intent is essential for this strategy.

Incorporating original, high-quality video and imagery in your webpage content gives you more opportunities to appear in rich results, as well.

And in local search results (the Map Pack), we saw the addition of new attributes for various sectors of the financial services industry added throughout the pandemic

Which Google Business Profile attributes are available to your listing depends on its primary category.

Banks, insurance agencies, and mortgage brokers, for example, can use attributes for online appointments, appointment links, ATMs, drive-thru services, and more.

More broadly available attributes enable you to share health and safety information, COVID-19 guidelines and safety measures, accessibility information, and more.

See the Complete Guide to Google Attributes for Local SEO to learn more.

Tips And Takeaways

Explore SERPs For Your Most Valuable Keywords

Look for opportunities to outrank competitors in unique SERPs features or by being the first-mover where opportunities for richer results may exist.

When Creating And Optimizing Content, Focus On Topical Relevance And Context

As opposed to making sure you use the keyword multiple times on a page.

Of the top 1000 banking terms, our research has found that pages that rank #1 use that top keyword just once, on average.

Context is more important than keyword density for banking.

Consider New Content Length Carefully

While we know word count is not a ranking factor, our research has found that the average word count for pages in the top three positions across the top 1000 banking terms is 1,240 words.

While this shouldn’t be considered a hard and fast rule, we do see more comprehensive content achieving higher rankings in this sector.

Be sure to analyze your own SERPs and aim to provide the most comprehensive and highest quality content for each target keyword.

3. Consumer Trust And Information Accuracy Are Increasingly Important In SEO

COVID-19 brought with it a massive transition to online and unfortunately, an associated onslaught of misinformation, cyber-attacks, scams, and fraud.

Bad actors raced to capitalize on increased online searches around and searches for payday loans, grants, jobs, and other help as consumers’ financial concerns grew.

In its pursuit to always provide the best answer for each query, Google has had its hands full algorithmically weeding out results that have the potential to negatively impact searchers.

Finance sites fall into a category Google calls Your Money or Your Life (YMYL), in which websites are held to a higher standard

A concept called E-A-T – Expertise, Authoritativeness, and Trustworthiness – factors heavily into YMYL site rankings as Google aims to surface the highest quality answers in its rankings.

Google recommends that those in the YMYL category self-assess your content, asking, “Would you feel comfortable trusting this content for issues relating to your money or your life?”

Tips And Takeaways

Get To Know Google’s Search Quality Raters Guidelines

Though not a ranking factor themselves, Google encourages content publishers to refer to this resource “for advice on great content.”

Incorporate Regular Content Audits And Updates Into Your SEO Strategy

Ensure that any outdated information is promptly removed from Google Posts, the blog, etc.

This is not only an SEO best practice but a regulatory requirement for many in the financial services sector, as well.

Don’t Ignore Your Presence In Social Media

When we look at who has the top share of voice for the top 1000 banking terms, Facebook is in the top 5 for organic winning many bank names and even non-brand terms.

Ensuring your profiles are complete and using targeted terms can give you another resource to win visibility in search beyond your website’s listings.

4. Finance Becomes Mobile-First

Visiting ATMs to withdraw for cash purchases, meeting up with a financial advisor, and visiting the local branch for lending needs are not yet obsolete but certainly giving way to more self-serve options.

Digital natives – that is, those who prefer to conduct their banking digitally and have no use for branches or offices at all – made up 32% of PwC’s 2021 Digital Banking Consumer Survey.

And often, consumers are conducting these activities on their mobile phones.

Retail banking has become an omnichannel experience for many.

And as McKinsey experts said in their article Transforming the US consumer bank for the next normal.

“To boost digital customer experience, banks need to design their solutions based on a deep understanding of what drives customer perceptions of convenience. For a long time, this meant a branch on every corner.

Today, while physical presence remains important, convenience also correlates with the ease, speed, and simplicity of an omnichannel experience.”

Google understands the importance of this ease of use, simplicity, and speed – so much so that its Page Experience update and Core Web Vitals metrics made meeting these objectives even more impactful in its search ranking algorithms.

Finance consumers are looking for intuitive apps, seamless cross-channel experiences, personalized service and offers, and near real-time decisions.

Transactions such as loan applications or mortgage pre-approvals that used to involve a series of in-person appointments and a great deal of paperwork can now come back in minutes.

It is imperative that the pages these tools live on and other informational content load near-instantly – or consumers will move on to the next result.

Tips And Takeaways

Mobile Security Is Mission-critical

With digital adoption comes enhanced consumer expectations that their privacy and financial data are being protected.

Optimize For Voice Search

With greater reliance on mobile devices and the proliferation of voice-enabled in-home assistants such as Google Home and Alexa, optimizing for these types of queries is key.

Fully 71% of consumers prefer to use voice for search queries as opposed to typing, according to PwC.

Voice-optimized content may differ in a variety of ways including structure, the intent being targeted, content length, format, and markup.

Measure And Optimize For Core Web Vitals

Your rankings will not suffer directly if this is not an area of focus. However, Google gives those who meet its CWV requirements a “boost” in search rankings and in competitive finance spaces, this could really move the needle.

Conclusion

Following Google’s best practices and keeping pace with algorithmic change is essential for SEO in the Financial Services sector.

It is also equally as important to ensure that marketers utilize market insights to stay ahead of category and consumer trends and automate to quickly fix site content for search compliance.

The competition is always high in the finance and banking sectors and with the rise of fintech, SEO can help financial brands stay on top.

More resources:

Featured Image: Billion Photos/Shutterstock