IAB NewFronts, billed as “the world’s largest digital content marketplace,” kicked off on Monday with in-person events in New York City and virtually on IAB.com.

The unifying theme of this year’s series of events for media buyers is “Stream On,” which reflects the twin trends driving the industry: Both consumers and brands are leaning into streaming video.

Here are the top three takeaways from Day 1 of the 2022 IAB NewFronts.

Image from YouTube, May 2022

Image from YouTube, May 20221. Setting The Agenda: Harnessing The Creator Economy

Tara Walpert Levy, Vice President of Americas at YouTube, and Michael Kassan, Chief Executive Officer of MediaLink, set the agenda for the 2022 IAB NewFronts to discuss “Harnessing the Creator Economy.”

During the discussion held at Google’s Pier 57, Walpert Levy announced that beauty star Jackie Aina and makeup artist Pat McGrath would lead a live shopping event on May 3 featuring items inspired by the Netflix series Bridgerton.

Then, YouTube will team up with Paramount on May 4 to live stream the premiere of the incoming film sequel Top Gun: Maverick.

Now, the elephant in the room that few in the industry trade press have yet to acknowledge is this:

- YouTube is fueling the economy, generating $20.5 billion to the US GDP in 2020.

- YouTube is creating employment, adding 394,000 full-time equivalent jobs in the US in 2020.

- YouTube is growing small businesses, prompting 80% of SMBs with a YouTube channel to agree that YouTube played a role in helping them to grow their customer base.

A Creator Coffee Talk featuring: Colin Rosenblum and Samir Chaudry, two filmmakers based in Los Angeles; Cassey Ho, a certified Pilates and fitness instructor whose “blogilates” channel on YouTube has 6.4 million subscribers; and Collins Key, who posts funny comedy videos on a YouTube channel with 23.7 million subscribers.

Image from YouTube, May 2022

Image from YouTube, May 2022They talked about their evolution from “YouTubers” and influencers to creators and entrepreneurs. The panel gave a shout-out to YouTube for paying creators more than $30 billion between 2017 and 2020 – $7.5 billion annually on average.

In 2021, YouTube brought in $28.8 billion in advertising revenue.

With around 55% of that going to creators, this means YouTube paid creators more than $15 billion last year, which is a huge chunk of the overall funding for the creator economy.

Other social video platforms have invested only hundreds of millions of dollars to “support” influencers and creators.

Or, as Key said,

“The rev split that YouTube gives us is what allows us to build these businesses. And as a creator, it’s so frustrating because I hear every platform is saying, ‘Oh yeah, we support our creators. We’re behind our creators.’ But no one’s putting their money where their mouth is except for YouTube.”

Now, YouTube normally holds its annual Brandcast during the IAB NewFronts, but the company has bucked tradition this year by moving that event to coincide with the Upfronts, the annual marketplace for TV ad sales.

This means we’ll have to wait until May 17 to learn what YouTube CEO Susan Wojcicki will say.

But, Jim Louderback, the GM of VidCon, predicts her presentation will emphasize that “Big Red is as much a TV company as it is an online video platform.”

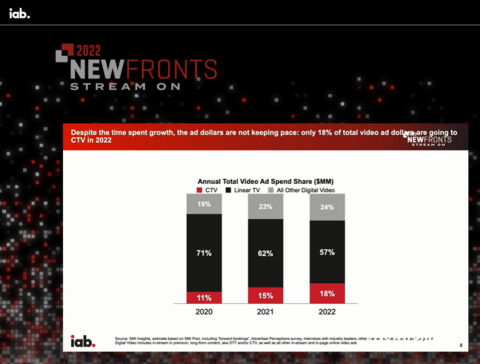

2. IAB Insights: 2022 Video Ad Spend Report

On Monday, IAB Media Center Vice President Eric John shared the findings of this year’s “Video Ad Spend and 2022 Outlook” report.

Digital video advertising spending increased 49% in 2021 and is expected to increase 26% to $49.2 billion in 2022.

And Connected TV (CTV) ad spending surged 57% in 2021 to $15.2 billion and is expected to grow an additional 39% in 2022 to $21.2 billion.

Even though 76% of video buyers now label CTV as a “must buy” in their media planning budgets, they’re currently allocating only 18% of their total video ad dollars to CTV, which falls short of the 36% of total time spent with linear TV and CTV combined in 2022.

John said, “The time is now for brands and buyers to follow consumer attention.”

Image from NewFront, May 2022

Image from NewFront, May 2022The report found:

- CTV enables buyers to leverage several types of data not available within linear TV buys, including first-party brand data, location data, and shopping data.

- 57% of video buyers with sales lift as their KPI felt that CTV was more effective than linear TV. But even 46% of video buyers with improving brand perception as their KPI said that CTV was more effective.

- 59% of video buyers said it was “very clear” where their CTV ads ran compared to only 50% who said that for social video and 43% for other digital video.

But, video buyers say they still face challenges:

- 48% said measuring incremental reach across platforms/publishers was an issue.

- 43% said managing frequency across platforms/publishers was a problem.

- 35% said fragmentation continues to be the Achilles heel of programmatic supply paths.

Video buyers are preparing for a converged linear TV/CTV marketplace and are implementing a myriad of creative and targeting tactics to address CTV’s opportunities and challenges.

But, John observed, “To use a baseball analogy, we’re still in the first inning.”

3. New Virtual Product Placement Offering From Amazon

On Monday evening, Amy Poehler, who is not only an Emmy-award-winning actress but also the director of Lucy and Desi on Prime Video and an executive producer on Harlem, hosted Amazon’s event at the Lincoln Center.

Eight executives from Freevee, Amazon Ads, Twitch, Prime Video, Amazon Music, and Amazon Studios joined her to unveil new shows, ad products, and ways to engage customers.

Image from NewFront, May 2022

Image from NewFront, May 2022The top takeaway from Amazon’s plethora of pronouncements was a new virtual product placement offering that inserts brands into Prime Video and Freevee original content in post-production and during Thursday Night Football, which will be streaming exclusively on Prime Video this fall.

If you haven’t heard of Freevee before, don’t worry. Up until last week, it was known as IMDb TV.

In other news, Amazon also announced Streaming TV Media Planner, which enables advertisers to see their incremental streaming TV reach through Amazon Ads and compare that to linear reach.

These were just the top three takeaways from Day 1 of the 2022 IAB NewFronts.

Over the next three days, media buyers will also hear from Meta, TikTok, Snapchat, and Twitter.

I’ll share the highlights from those events later this week.

More resources:

Featured Image: AlessandroBiascioli/Shutterstock