Regulation splits the internet experience, a.k.a. Search, into a European and American version with stark differences.

While big tech companies face complexity, Search players have an opportunity to compare SERP features and AI Overviews in both internet versions and better understand their impact.

AI on Innovation, I mentioned that:

Differences in AIO design might arise between the EU and non-EU countries. New regulations and fines lower the appetite for tech companies like Alphabet, Meta, or Apple to launch AI features in the EU. The result could be two internets that allow us to compare the impact and changing AI landscape in countries like the U.S.

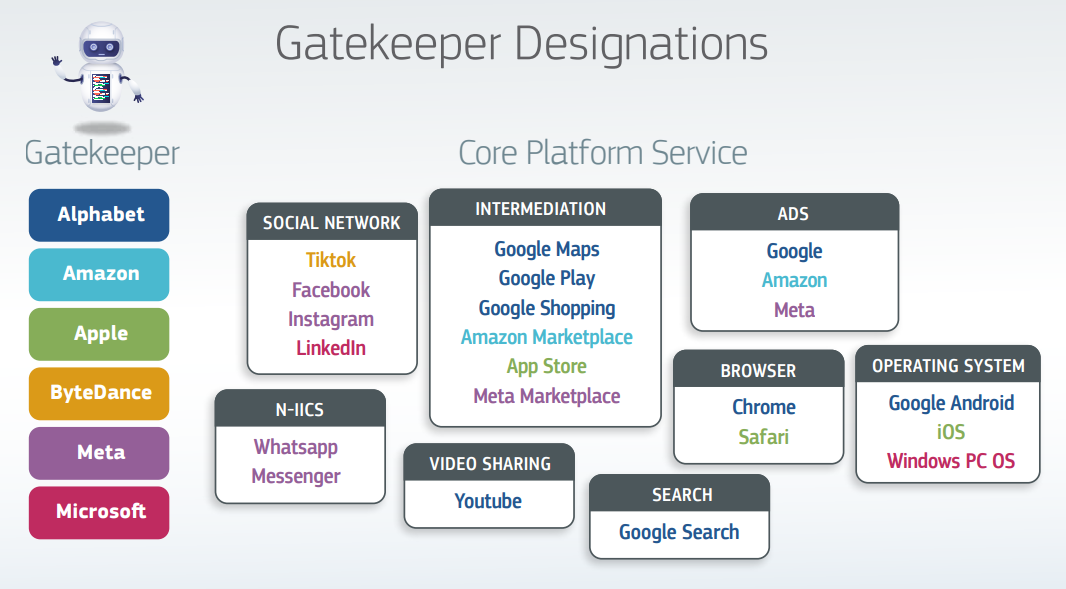

The Digital Marketing Act (DMA) is the European Union’s tech gatekeeper regulation and is responsible for splitting the web by creating distinct experiences in the EU compared to the U.S.

It rules that companies can no longer force defaults on users (like a search engine or browser), show their offering above other marketplace participants, and serve targeted ads without consent. They must guarantee interoperability, data access, ad transparency, and side loading.

Seven gatekeepers experience significant circumcisions in their EU product versions: Alphabet, Amazon, Apple, Bytedance, Booking, Meta, and Microsoft.

Gatekeepers, as defined by the DMA (Image Credit: Kevin Indig)

Gatekeepers, as defined by the DMA (Image Credit: Kevin Indig)In 2024, the DMA forked the Search experience:

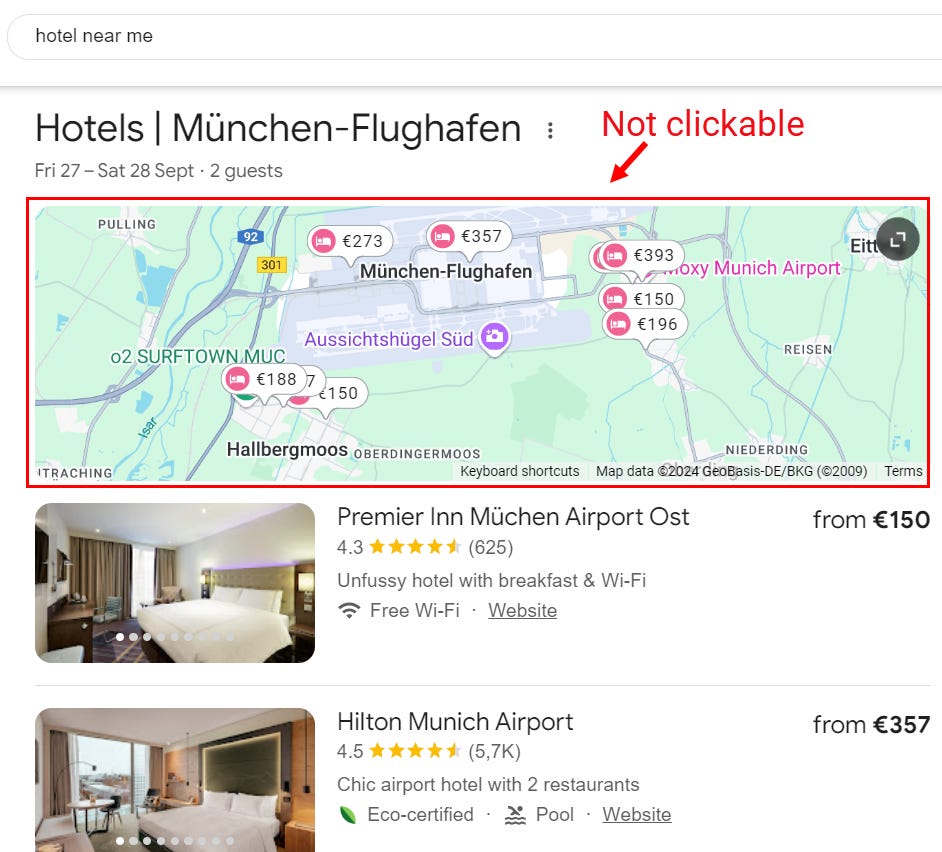

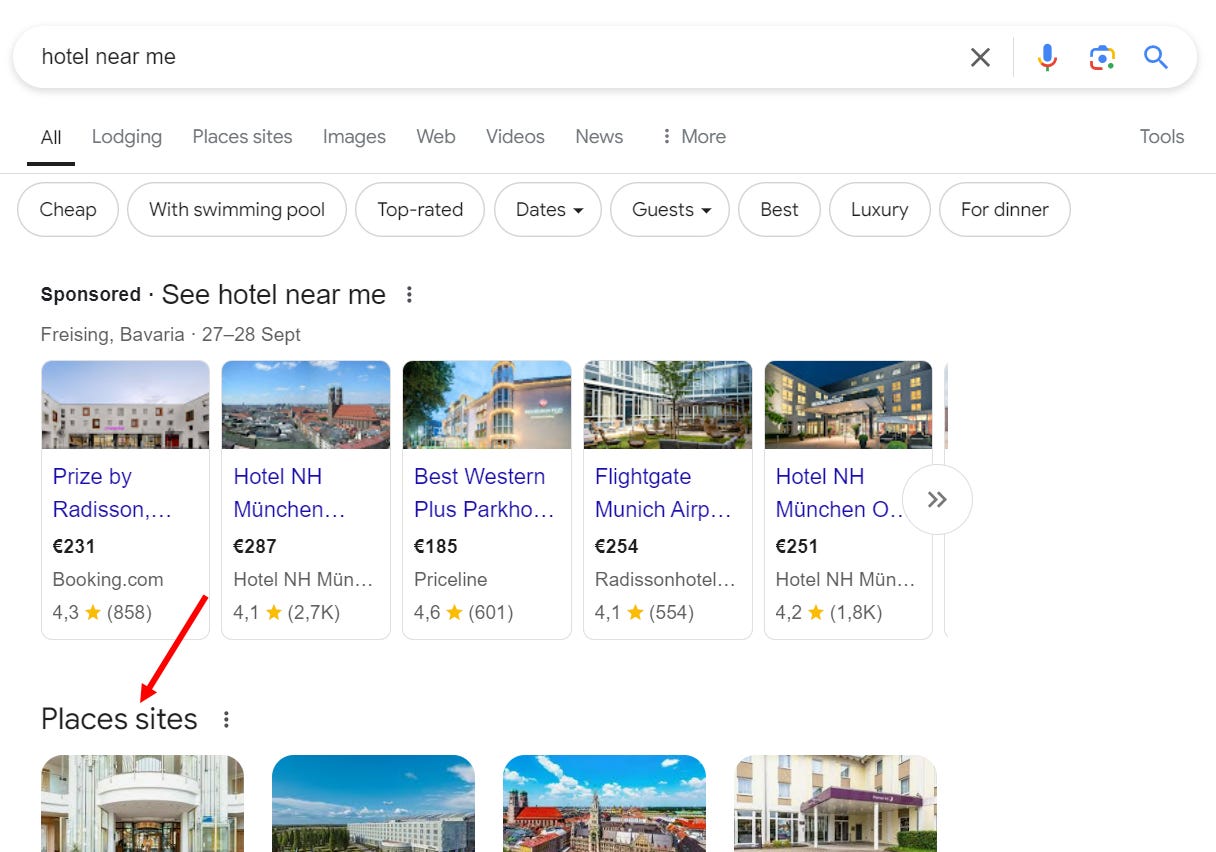

1. Hotels And Flights

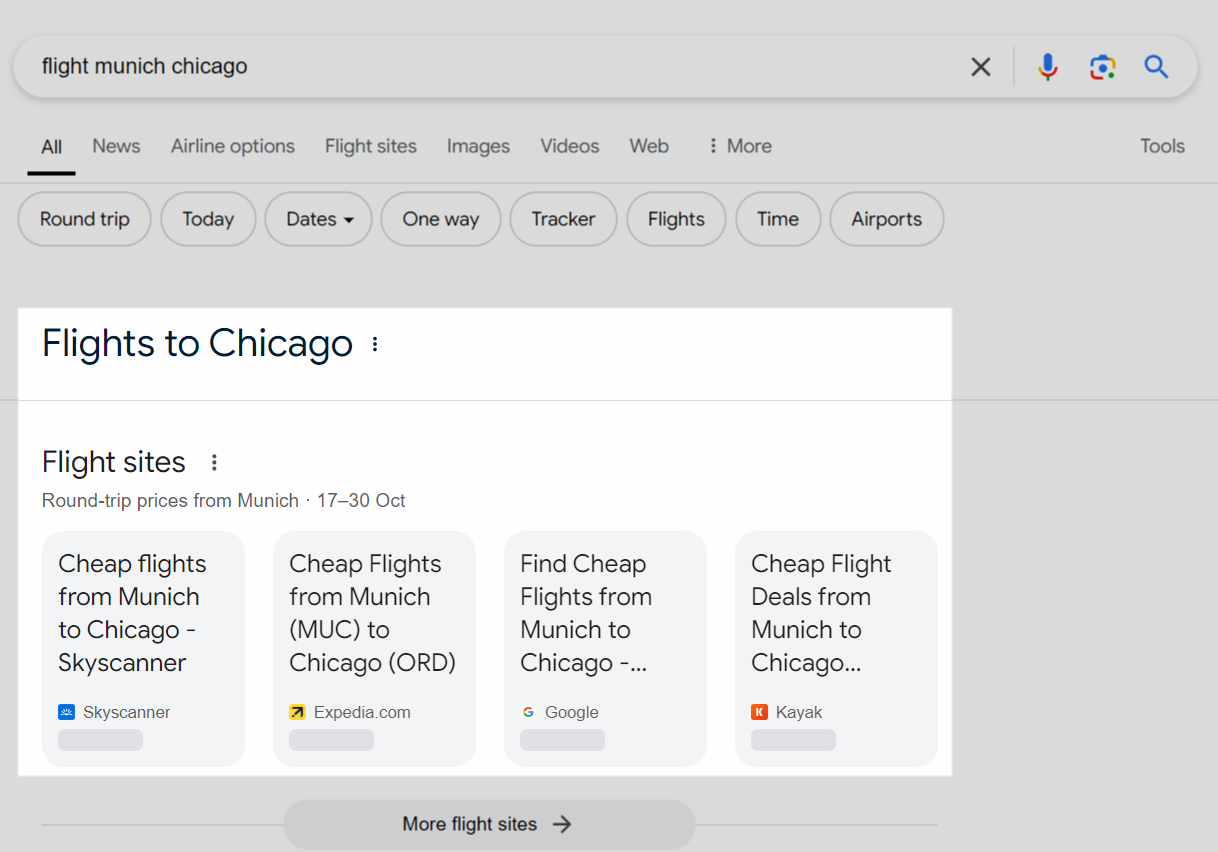

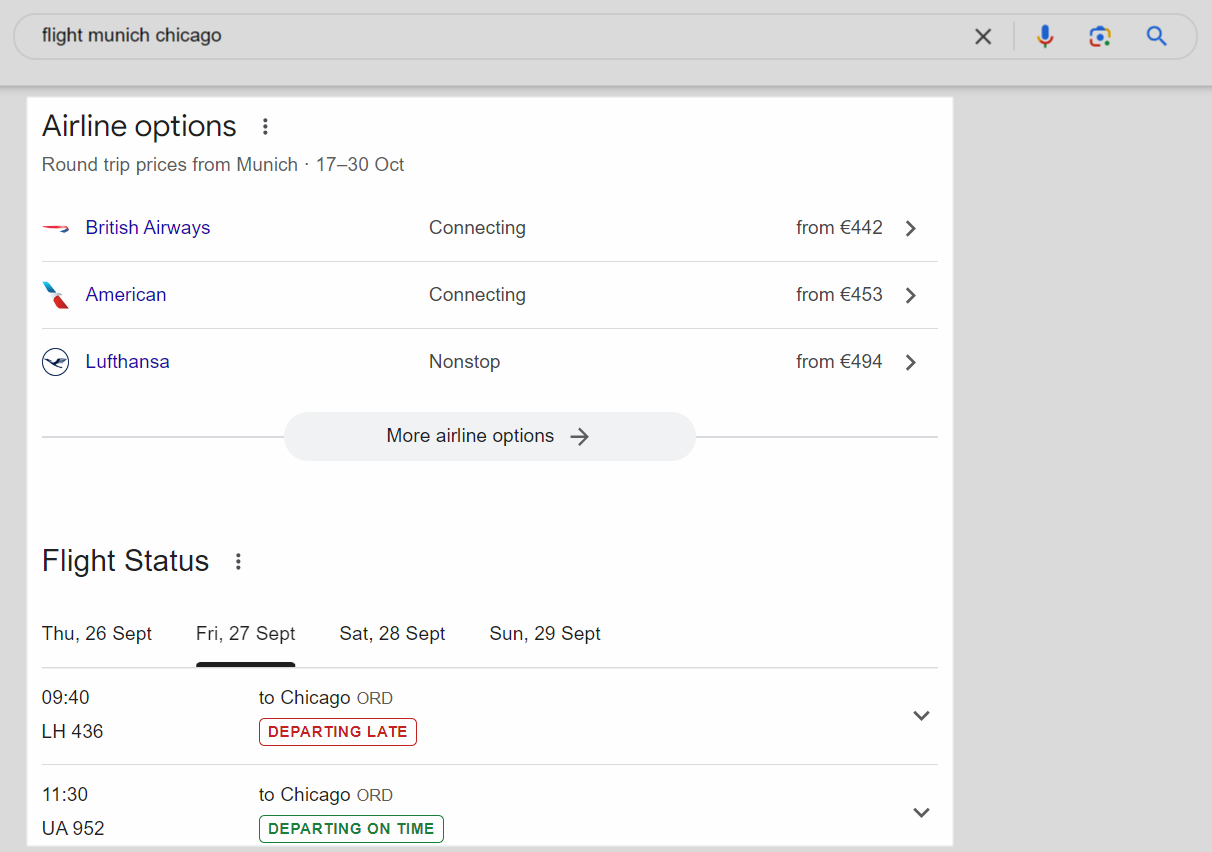

Google’s Hotel and Flight SERP feature is deemed “self-preferencing” under the DMA, which is why the modules look significantly different in the EU compared to the U.S.

Since March 2024, the EU SERP has shown “travel sites” and “hotel sites” boxes at the top with links to aggregators instead of Google’s own modules.

In the EU, Google shows “Flight sites” instead of its own flight search module. (Image Credit: Kevin Indig)

In the EU, Google shows “Flight sites” instead of its own flight search module. (Image Credit: Kevin Indig) Further down the SERP, Google shows a selection of flights from different airlines. (Image Credit: Kevin Indig)

Further down the SERP, Google shows a selection of flights from different airlines. (Image Credit: Kevin Indig)The impact seems to favor online travel agencies (OTAs) over hotel brands and airlines.

Hotel booking engine Mirai found a 30% reduction in paid clicks and -36% in direct visits in the EU vs. the U.S. after Google demoted its flights and hotel SERP feature.

In Favoritism, I described how Google gives more visibility to brands in organic search over OTAs and other aggregators. It’s possible that Google is trying to balance traffic to flight and places sites with more brands in the classic organic results.

Users cannot click on Map Packs in the EU. (Image Credit: Kevin Indig)

Users cannot click on Map Packs in the EU. (Image Credit: Kevin Indig) “Places sites” are the equivalent of hotels to “Flight sites.” (Image Credit: Kevin Indig)

“Places sites” are the equivalent of hotels to “Flight sites.” (Image Credit: Kevin Indig)The EU is not the only one that has seen a problem with Google’s SERP features.

First, Yelp filed a lawsuit against Google in 2024 for using SERP features to keep traffic on its site and illegally scraping and using Yelp’s content.

In Augmentation, I presented data and studies showing that SERP features have a net negative effect on clicks.

Second, the FTC reviewed Google’s SERP features but didn’t find them to be a problem in 2013 – a big mistake.

While Google’s prominent display of its own vertical search results on its search results page had the effect in some cases of pushing other results “below the fold”, the evidence suggests that Google’s primary goal in introducing this content was to quickly answer, and better satisfy, its users’ search queries by providing directly relevant information.

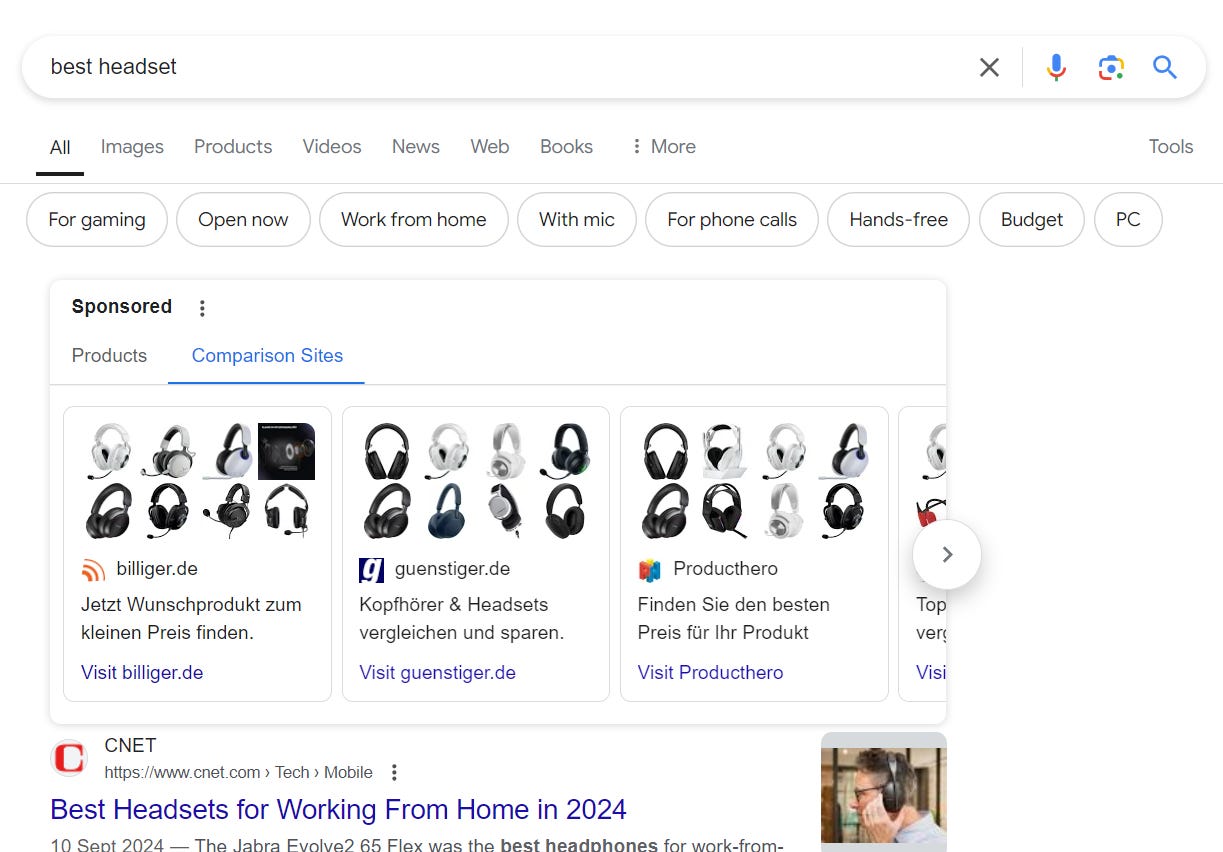

2. Shopping

In September, the EU fined Google $2.8 billion for showing price Product Listing Ads (PLAs) above blue links to price comparison sites and demoting price comparison sites in organic search with algorithm updates.

Since then, Google has shown a box with links to price comparison sites for shopping searches, as for hotel and flight searches.

Links to price comparison sites on Google (Image Credit: Kevin Indig)

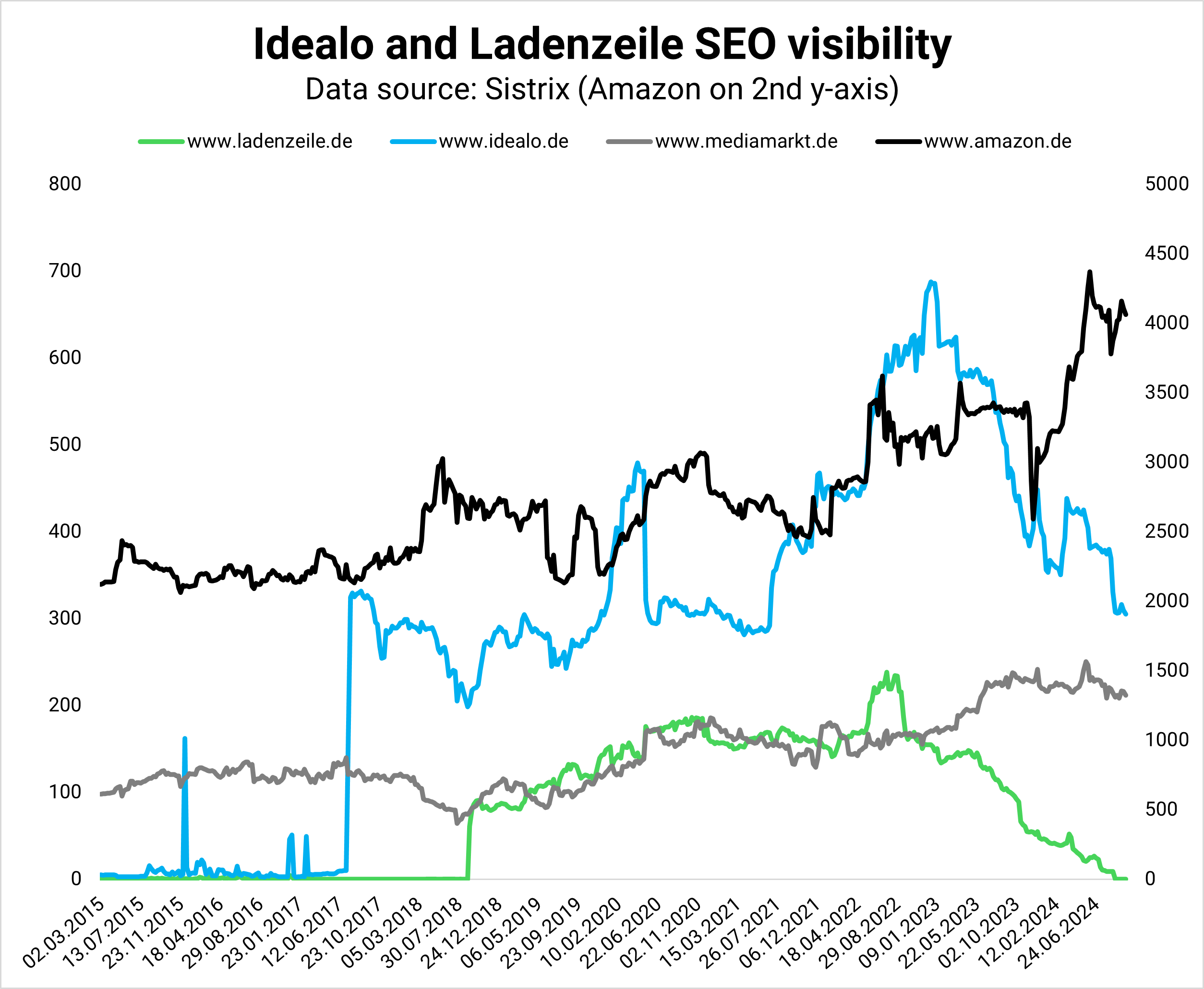

Links to price comparison sites on Google (Image Credit: Kevin Indig)The DMA, which classified PLAs as self-preferencing, came a few months too late for sites like Ladenzeile, Idealo, or Shopalike.

Owner Axel Springer had to shut them down in June after Google Core Updates shot golf ball-sized holes into their armor.

Big shopping retailers like MediaMarkt and Amazon gained the visibility that Ladenzeile & Co. lost in Germany.

Image Credit: Kevin Indig

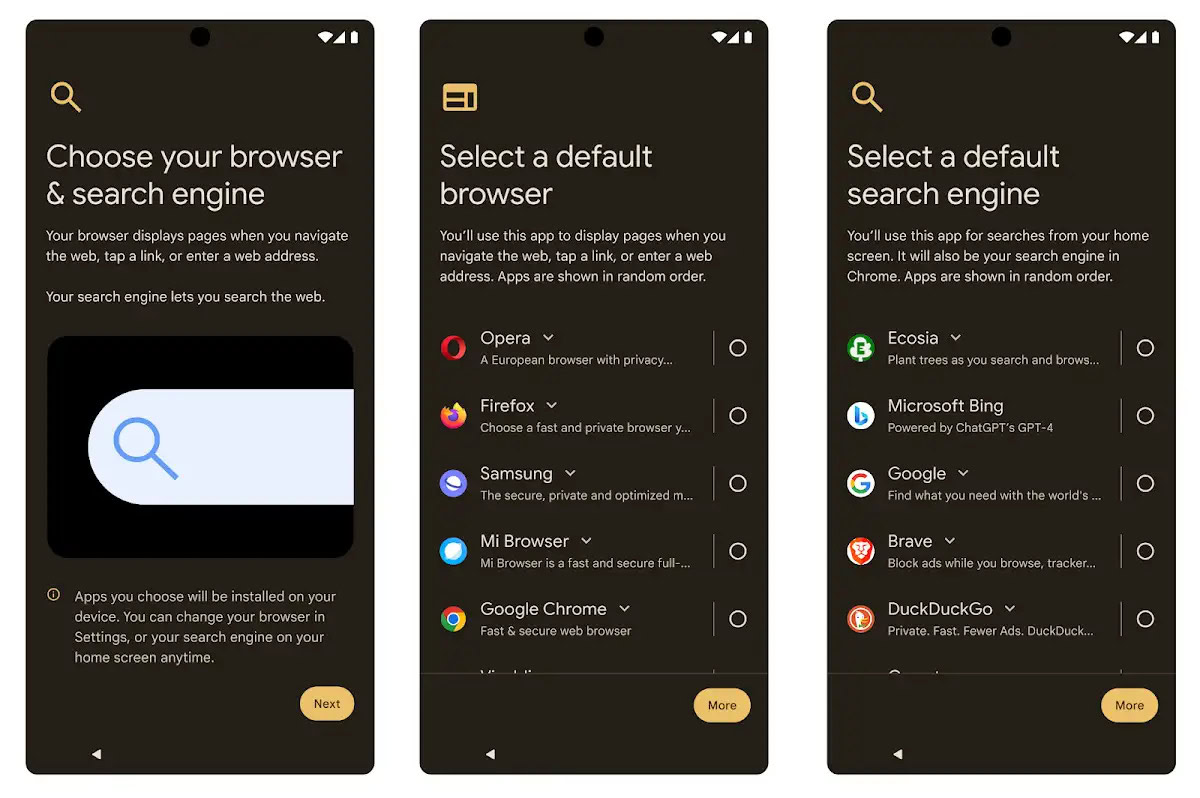

Image Credit: Kevin Indig3. Default Search Engines

Since March 2024, Google needs to let users in the EU choose a default search engine on Android and Chrome.

It’s a precursor for what’s likely to be a remedy in the current DOJ lawsuit against Google in the U.S.

Android choice screens for search engines (Source)

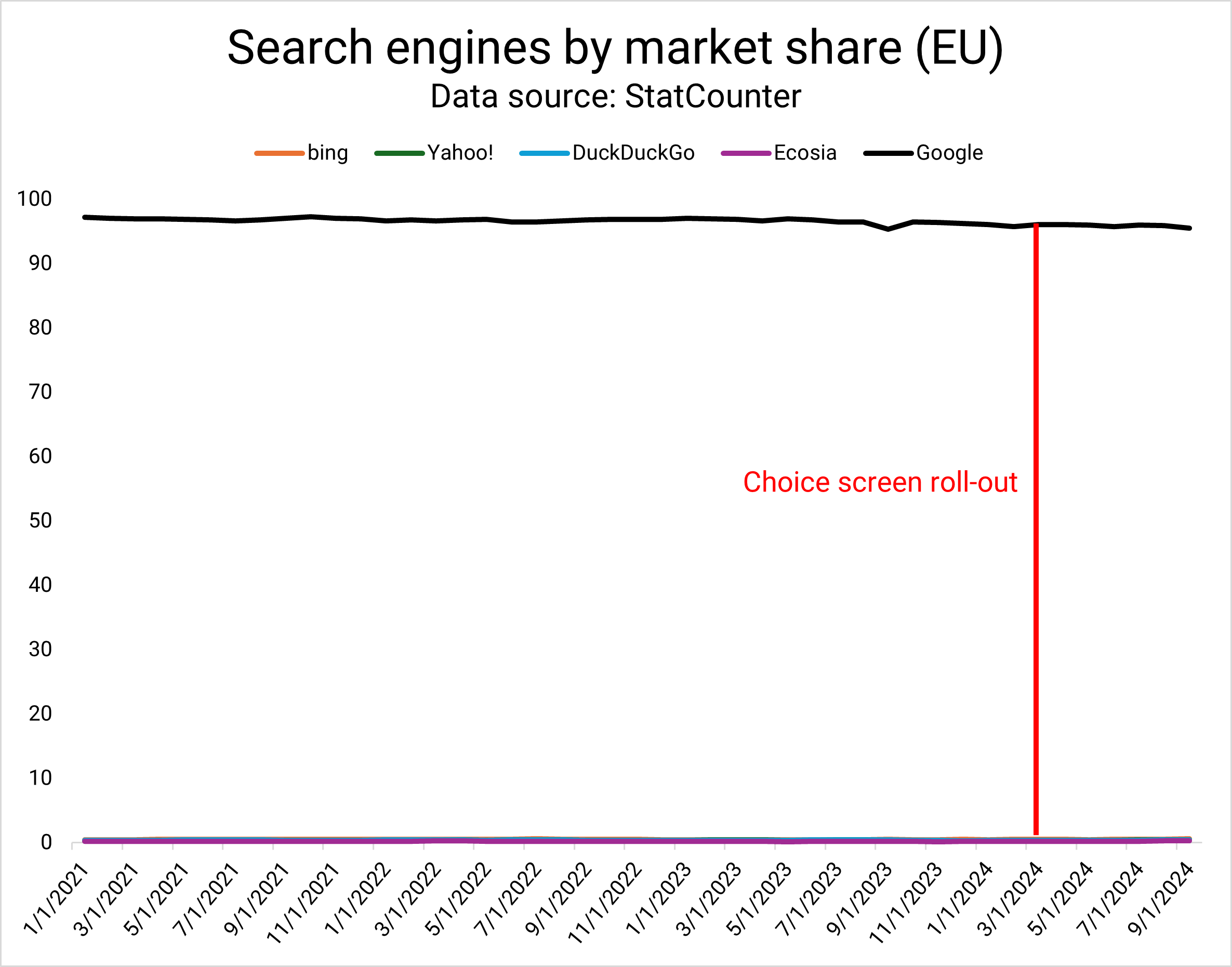

Android choice screens for search engines (Source)However, most users still choose Google despite randomized choices for other search engines since the search engine market share distribution in the EU remains unchanged.

The DMA didn’t make a dent in Google’s EU search engine market share. (Image Credit: Kevin Indig)

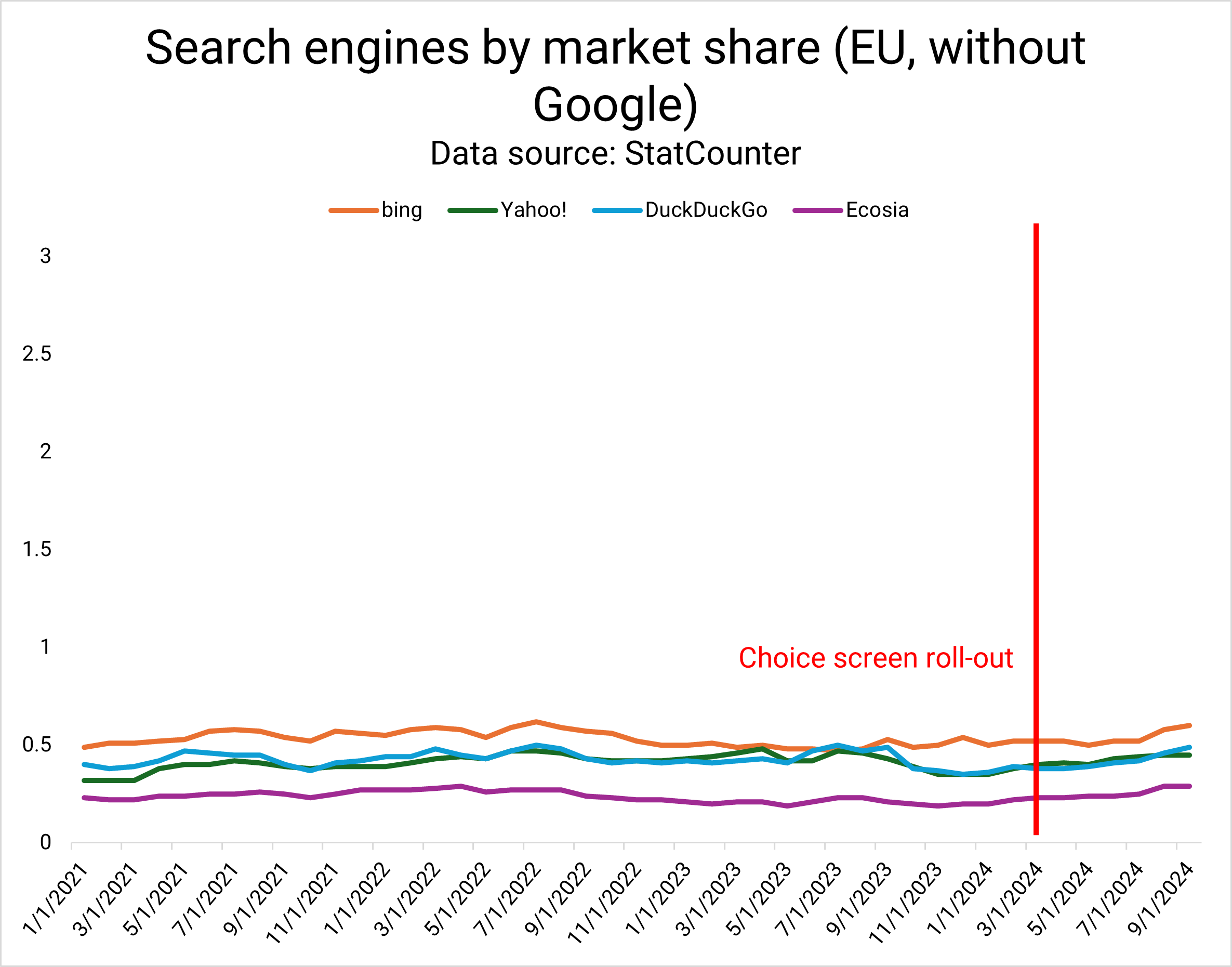

The DMA didn’t make a dent in Google’s EU search engine market share. (Image Credit: Kevin Indig) Even when taking Google out of the chart, gains are barely visible. (Image Credit: Kevin Indig)

Even when taking Google out of the chart, gains are barely visible. (Image Credit: Kevin Indig)So far, the impact of the DMA on Google seems minimal or non-existent, and users are getting frustrated with the circumcised SERP experience.

Stable market share in the EU shows that Google has won Search, and antitrust lawsuits are coming too late.

The lawsuits against gatekeepers and resulting remedies are not without controversy, but I don’t see the EU backing down. The DMA will continue to diverge the internet experience in the U.S. and EU, probably to an advantage for EU sites.

Global companies operating in the U.S. and EU can compare the impact of SERP features and AI Overviews to better understand their impact.

You can measure differences in clicks, impressions, and CTR by comparing the same keywords in different countries in the same position. You could already do that today with AI Overviews, for which Google doesn’t really provide any data.

At the same time, it will be interesting to see if Google’s free product listings and AI Overviews will be seen as self-preferencing.

After Google’s transition from a search engine to a shopping marketplace, free and paid shopping grids appeared in regular searches, not just the shopping tab.

I wrote in ecommerce shifts

Just in time for the shopping season, Google made product filters permanent for queries with clear intent after testing the feature for about a year. What used to be the Google Shopping tab is now the default for Search.

Google replayed its boiling frog playbook: habituate users with small features and slowly expand. Google first showed paid listings (PLAs), then organic listings, and now a full product search page.

For merchants and retailers, the new marketplace layout can significantly disrupt organic traffic. Google has highlighted the importance of the Merchant Center for paid and organic listings for a while now, likely to prepare merchants for the coming transformation. Within this change, classic Search is becoming less important and marketplace optimization more important.

It’s possible that Google already expects the DMA to see AI Overviews as a DMA violation, which is why it launched in the UK, India, Japan, Mexico, Brazil, and Indonesia – but not in the EU. They also didn’t roll out in Australia and Canada, where governments try to force Google to pay publishers.

While the EU becomes a tougher market for U.S. tech companies, it might become more attractive for European players, which is the purpose of the DMA.

For companies with an affiliate or ad-revenue business model, the EU could become a refuge where growing SEO traffic is easier.

However, a change in SERP design does not protect sites from losing organic traffic in classic results, as we can see in the example of Idealo and Ladenzeile.

DMA implementation sinks 30% of clicks and bookings on Google Hotel Ads

How the European Commission Is Making Google a Worse Product (Again)

Featured Image: Paulo Bobita/Search Engine Journal