When launching a new product/company or pitching for additional funding, forecasting against your TAM (total addressable market) is a key component.

The TAM is a key part of a user acquisition strategy and your SEO campaign alike.

It can help you prioritize optimization activities and forecast traffic potential based on your pre-determined keyword sets.

Your total addressable market differs from your total market, as your total market is your maximum potential opportunity if no competition or alternate products with differing USPs (unique selling proposition) exist.

Your TAM is a fraction of this market but is more closely tied to your personas and potential users whose needs are more closely aligned with your product/service.

What Is The Total Addressable Market (TAM) Formula?

The defined formula for calculating your TAM (in a general business sense) is:

Potential Market x Competitive Position = TAM

Your potential market is the number of potential users, e.g. the number of email users in the world is estimated to be around 4.03bn, but if your competitive position is to cater to U.S. users only, your TAM is approximately 250 million.

Your TAM can also be influenced by users who use adjacent products.

For example, suppose you’re an online service that focuses on user privacy as a core USP.

In that case, users of other privacy-focused products such as Brave (browser) and DuckDuckGo may fall into your overall TAM.

When we look at our SEO TAM, however, we can use existing tools and data to create estimations of our total TAM and then break it down by potential user needs (matching your personas).

Establishing Your TAM

Establishing your SEO TAM, for me, is a three-step process:

- Fully identify and identify product USPs and capabilities (current, and forecast).

- Comprehensive keyword research around your product/service/offering.

- Traffic estimations (click curves and opportunity gap analysis).

For the first step, you can achieve this by meeting with product owners and managers, and asking them about product details, functionality, features, and the product roadmap.

This information can then be used to inform your keyword research to create better content, but also a more valid user experience.

It allows the user to forecast their experience of the product more accurately, reducing both churn and redundancy in the pipeline of unqualified leads.

From experience, these meetings can also help identify some potential angles and messaging that can be included in content that competitors overlook.

The second step is to perform comprehensive keyword research and categorization. As well as categorizing by intent, this is also a good opportunity to categorize by funnel stage.

The third step is to create traffic estimations – and you can do this from your keyword research, the current ranking positions of your target website (if any), and whether or not the SERPs (search engine results pages) for the keywords contain SERP features.

To show this process, I’m going to use the company Narmi as an example (using publicly available data through SEO tools).

The Narmi website currently ranks for approximately 800 keywords in the U.S. and based on estimated SERP CTR data the terms are producing around 500 sessions a month.

If the domain ranked in position one for all 800 search terms, the total potential organic traffic is around 81,000.

Now, this is taking the raw data set. To get a more realistic TAM estimation, you will also need to:

- Add in additional search terms that you don’t currently rank for, but want to.

- Remove irrelevant search terms from the data set, e.g. random brands you rank in position 81 for that have been picked up because you mentioned them once in a blog post.

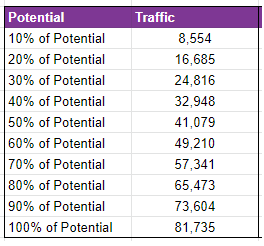

Ranking for position 1 for all potential search terms isn’t realistic.

But with your data, you can create a stepped approach to show what improvements can be made if things were 10% better, 20% better, and so on.

-

Screenshot taken by author, June 2022

Screenshot taken by author, June 2022

From this, you can demonstrate to other stakeholders and potential investors what improvement is required to hit specific organic traffic goals – and then tie effort values back to resources required.

Utilizing Your TAM

As well as traffic forecasting, your TAM data can be utilized further to forecast leads and transactions.

Lead Forecasting

For most SaaS and lead generation model companies, the pipeline is the most important metric that the majority of C-level and other stakeholders point to.

This can be calculated in a similar fashion to the potential traffic opportunity and can be modeled using your existing lead data.

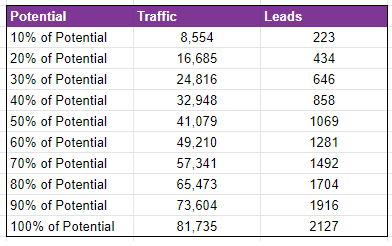

Using the Narmi estimations, and assuming they currently get 11 SQLs (sales qualified leads) each month, we can model that it takes on average 38 sessions for every SQL.

Based on that conversion rate, the potential lead opportunity on the keyword set is estimated to be 2,116 a month.

Again, this is modeled at 100% first position ranking, but like with traffic estimations we can model this based on incremental performance increase:

-

Screenshot taken by author, June 2022

Screenshot taken by author, June 2022

This can be expanded further if the forecasted lead number is multiplied against the lead value and used to forecast longer-term based on churn rates and LTV (lifetime value).

This can also identify if there are retention issues.

If the pipeline is showing sufficient numbers for the free trial sign-up, but then not enough are converting to paid users, then focus can be turned to either product, or customer service/SDRs (sales development representatives), and potential uncover issues with onsite content and product messaging.

Transaction Forecasting

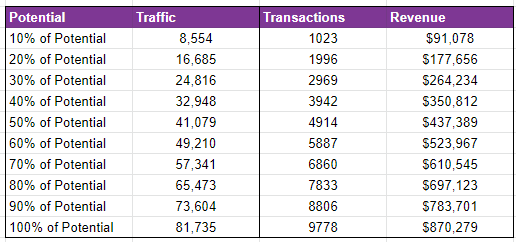

If you’re an ecommerce store then you can do similar forecasting for the number of transactions you may attain, and total revenue (based on your current or forecast AOV).

If your data fluctuates a lot seasonally or due to the nature of the products you sell, you can break this down by a product category, or even a seasonal category and blend the forecasts together.

Again, you can compare your total organic transaction and revenue potential data to incremental gains:

Screenshot taken by author, June 2022

Screenshot taken by author, June 2022For example, is the current user journey and site conversion rate enough to generate the leads/transactions required to generate an ROI (return on investment) and growth?

Forecasting transactions or leads on existing can help in identifying both opportunities and problems that otherwise may not come to light until they are either missed or being experienced.

More resources:

Featured Image: as-artmedia/Shutterstock