Since Elon Musk’s takeover of Twitter last October 27, 2022, things at the social media company have gone from bad to worse.

You probably saw this coming from a mile away – especially if you had read about a study by Media Matters that was published on November 22, 2022, entitled, “In less than a month, Elon Musk has driven away half of Twitter’s top 100 advertisers.”

If you missed that, then you’ve probably read Matt G. Southern’s article in Search Engine Journal, which was entitled, “Twitter’s Revenue Down 40% As 500 Top Advertisers Pull Out.”

This mass exodus creates a challenge for digital advertising executives and their agencies. Where should they go long term?

And what should they do in the short term – with Super Bowl LVII coming up on Sunday, February 12, 2023?

Ideally, these advertisers would follow their audience. If they knew where Twitter users were going, their ad budgets could follow them.

But it isn’t clear where Twitter users are going – or if they’ve even left yet.

Fake Followers On Twitter And Brand Safety

According to the latest data from Similarweb, a digital intelligence platform, there were 6.9 billion monthly visits to Twitter worldwide during December 2022 – up slightly from 6.8 billion in November, and down slightly from 7.0 billion in October.

So, if a high-profile user like Boston Mayor Michelle Wu has taken a step back from the frequent posts on her Twitter account, @wutrain, which has more than 152,000 followers, then it appears that other users have stepped up their monthly visits.

This includes several accounts that had been banned previously for spreading disinformation, which Musk unbanned.

(Disinformation is defined as “deliberately misleading or biased information,” while misinformation may be spread without the sender having harmful intentions.)

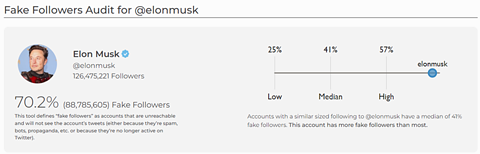

It’s also worth noting that SparkToro, which provides audience research software, also has a free tool called Fake Follower Audit, which analyzes Twitter accounts.

This tool defines “fake followers” as ones that are unreachable and will not see the account’s tweets either because they’re spam, bots, and propaganda, or because they’re no longer active on Twitter.

On Jan. 24, 2023, I used this tool and found that 70.2% of the 126.5 million followers of the @elonmusk account were fake.

According to the tool, accounts with a similar-sized following to @elonmusk have a median of 41% fake followers. So, Elon Musk’s account has more fake followers than most.

Screenshot from SparkToro, January 2023

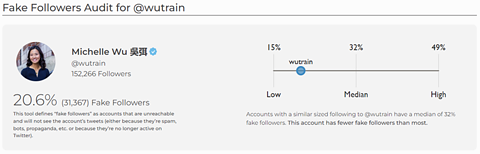

Screenshot from SparkToro, January 2023By comparison, 20.6% of the followers of the @wutreain account were fake. So, Michelle Wu’s account has fewer fake followers than accounts with a similar-sized following.

Screenshot from SparkToro, January 2023

Screenshot from SparkToro, January 2023In fact, most Twitter accounts have significant numbers of fake followers.

This underlines the brand safety concerns that many advertisers and media buyers have, but it doesn’t give them any guidance on where they should move their ad dollars.

Who Are Twitter’s Top Competitors And What Are Their Monthly Visits?

So, I asked Similarweb if they had more data that might help. And they sent me the monthly visits from desktop and mobile devices worldwide for Twitter and its top competitors:

- YouTube.com: 34.6 billion in December 2022, down 2.8% from 35.6 billion in December 2021.

- Facebook.com: 18.1 billion in December 2022, down 14.2% from 21.1 billion in December 2021.

- Twitter.com: 6.9 billion in December 2022, up 1.5% from 6.8 billion in December 2021.

- Instagram.com: 6.3 billion in December 2022, down 3.1% from 6.5 billion in December 2021.

- TikTok.com: 1.9 billion in December 2022, up 26.7% from 1.5 billion in December 2021.

- Reddit.com: 1.8 billion in December 2022, down 5.3% from 1.9 billion in December 2021.

- LinkedIn.com: 1.5 billion in December 2022, up 7.1% from 1.4 billion in December 2021.

- Pinterest.com: 1.0 billion in December 2022, up 11.1% from 0.9 billion in December 2021.

The most significant trends worth noting are monthly visits to TikTok are up 26.7% year over year from a smaller base, while monthly visits to Facebook are down 14.2% from a bigger base.

So, the short-term events at Twitter over the past 90 days may have taken the spotlight off the long-term trends at TikTok and Facebook over the past year for some industry observers.

But based on Southern’s article in Search Engine Journal, “Facebook Shifts Focus To Short-Form Video After Stock Plunge,” which was published on February 6, 2022, Facebook CEO Mark Zuckerberg is focused on these trends.

In a call with investors, Zuckerberg said back then:

“People have a lot of choices for how they want to spend their time, and apps like TikTok are growing very quickly. And this is why our focus on Reels is so important over the long term.”

Meanwhile, there were 91% more monthly visits to YouTube in December 2022 than there were to Facebook. And that only counts the visits that Similarweb tracks from mobile and desktop devices.

Similarweb doesn’t track visits from connected TVs (CTVs).

Measuring Data From Connected TVs (CTVs) And Co-Viewing

Why would I wish to draw your attention to CTVs?

First, global viewers watched a daily average of over 700 million hours of YouTube content on TV devices, according to YouTube internal data from January 2022.

And Insider Intelligence reported in 2022 that 36.4% of the U.S. share of average time spent per day with YouTube came from connected devices, including Apple TV, Google Chromecast, Roku, and Xfinity Flex, while 49.3% came from mobile devices, and 14.3% came from desktops or laptops.

Second, when people watch YouTube on a connected TV, they often watch it together with their friends, family, and colleagues – just like they did at Super Bowl parties before the pandemic.

There’s even a term for this behavior: Co-viewing.

And advertisers can now measure their total YouTube CTV audience using real-time and census-level surveys in over 100 countries and 70 languages.

This means Heineken and Marvel Studios can measure the co-viewing of their Super Bowl ad in more than 100 markets around the globe where Heineken 0.0 non-alcoholic beer is sold, and/or 26 countries where “Ant-Man and The Wasp: Quantumania” is scheduled to be released three to five days after the Big Game.

It also enables Apple Music to measure the co-viewing of their Super Bowl LVII Halftime Show during Big Game parties worldwide (except Mainland China, Iran, North Korea, and Turkmenistan, where access to YouTube is currently blocked).

And, if FanDuel has already migrated to Google Analytics 4 (GA4), then the innovative sports-tech entertainment company can not only measure the co-viewing of their Big Game teasers on YouTube AdBlitz in 16 states where sports betting is legal, but also measure engaged-view conversions (EVCs) from YouTube within 3 days of viewing Rob Gronkowski’s attempt to kick a live field goal.

Advertisers couldn’t do that in 2022. But they could in a couple of weeks.

If advertisers want to follow their audience, then they should be moving some of their ad budgets out of Facebook, testing new tactics, and experimenting with new initiatives on YouTube in 2023.

Where should the advertisers leaving Twitter shift their budgets long term? And how will that change their Super Bowl strategies in the short term?

According to Similarweb, monthly visits to ads.twitter.com, the platform’s ad-buying portal dropped 15% worldwide from 2.5 million in December 2021 to 2.1 million in December 2022.

So, advertisers were heading for the exit weeks before they learned that 500 top advertisers had left the platform.

Where Did Their Ad Budgets Go?

Well, it’s hard to track YouTube advertising, which is buried in Google’s sprawling ad business.

And we can’t use business.facebook.com as a proxy for interest in advertising on that platform because it’s used by businesses for other purposes, such as managing organic content on their Facebook pages.

But monthly visits to ads.snapchat.com, that platform’s ad-buying portal, jumped 88.3% from 1.6 million in December 2021 to 3.0 million in December 2022.

Monthly visits to ads.tiktok.com are up 36.6% from 5.1 million in December 2021 to 7.0 million in December 2022.

Monthly visits to ads.pinterest.com are up 23.3% from 1.1 million in December 2021 to 1.4 million in December 2022.

And monthly visits to business.linkedin.com are up 14.6% from 5.7 million in December 2021 to 6.5 million in December 2022.

It appears that lots of advertisers are hedging their bets by spreading their money around.

Now, most of them should probably continue to move their ad budgets into Snapchat, TikTok, Pinterest, and LinkedIn – unless the “Chief Twit” can find a way to keep his microblogging service from becoming “a free-for-all hellscape, where anything can be said with no consequences!”

How will advertisers leaving Twitter change their Super Bowl plan this year?

To double-check my analysis, I interviewed Joaquim Salguerio, who is the Paid Media Director at LINK Agency. He’s managed media budgets of over eight figures at multiple advertising agencies.

Below are my questions and his answers.

Greg Jarboe: “Which brands feel that Twitter has broken their trust since Musk bought the platform?”

Joaquim Salguerio: “I would say that several brands will have different reasonings for this break of trust.

First, if you’re an automaker, there’s suddenly a very tight relationship between Twitter and one of your competitors.

Second, advertisers that are quite averse to taking risks with their communications because of brand safety concerns might feel that they still need to be addressed.

Most of all, in a year where we’re seeing mass layoffs from several corporations, the Twitter troubles have given marketing teams a reason to re-evaluate its effectiveness during a time of budget cuts. That would be a more important factor than trust for most brands.

Obviously, there are some famous cases, such as the Lou Paskalis case, but it’s difficult to pinpoint a brand list that would have trust as their only concern.”

GJ: “Do you think it will be hard for Twitter to regain their trust before this year’s Super Bowl?”

JS: “It’s highly unlikely that any brand that has lost trust in Twitter will change its mind in the near future, and definitely not in time for the Super Bowl. Most marketing plans for the event will be finalized by now and recent communications by Twitter leadership haven’t signaled any change in direction.

If anything, from industry comments within my own network, I can say that comments from Musk recently (“Ads are too frequent on Twitter and too big. Taking steps to address both in coming weeks.”) were quite badly received. For any marketers that believe Twitter advertising isn’t sufficiently effective, this pushes them further away.

Brand communications should still occur on Twitter during Super Bowl though – it will have a peak in usage. And advertising verticals that should dominate the advertising space on Twitter are not the ones crossing the platform from their plans.”

GJ: “How do you think advertisers will change their Super Bowl plans around Twitter this year?”

JS: “The main change for advertising plans will likely be for brand comms amplification. As an example, the betting industry will likely be heavily present on Twitter during the game and I would expect little to no change in plans.”

In the FCMG category, though, time sensitivity won’t be as important, which means that social media teams will likely be making an attempt at virality without relying as much on paid dollars.

If budgets are to diverge, they will likely be moved within the social space and toward platforms that will have user discussion/engagement from the Super Bowl (TikTok, Reddit, etc.)”

GJ: “What trends will we see in advertising budget allocation for this year’s Super Bowl?”

Joaquim Salguerio: “We should see budget planning much in line with previous years in all honesty. TV is still the most important media channel on Super Bowl day.

Digital spend will likely go towards social platforms, we predict a growth in TikTok and Reddit advertising around the big day for most brands.

Twitter should still have a strong advertising budget allocated to the platform by the verticals aiming to get actions from users during the game (food delivery/betting/etc.).”

GJ: “Which platforms will benefit from this shift?”

JS: “Likely, we will see TikTok as the biggest winner from a shift in advertising dollars, as the growth numbers are making it harder to ignore the platform as a placement that needs to be in the plan.

Reddit can also capture some of this budget as it has the right characteristics marketers are looking for around the Super Bowl – it’s relevant to what’s happening at the moment and similar demographics.”

GJ: “Do you think advertisers that step away from Twitter for this year’s Big Game will stay away long term?”

JS: “That is impossible to know, as it’s completely dependent on how the platform evolves and the advertising solutions it will provide. Twitter’s proposition was always centered around brand marketing (their performance offering was always known to be sub-par).

Unless brand safety concerns are addressed by brands that decided to step away, it’s hard to foresee a change.

I would say that overall, Super Bowl ad spend on Twitter should not be as affected as it’s been portrayed – it makes sense to reach audiences where audiences are.

Especially if you know the mindset. The bigger issue is what happens when there isn’t a Super Bowl or a World Cup.”

More resources:

Featured Image: Brocreative/Shutterstock