Hello, my fellow search industry friends.

If you’ve followed me, you know I am a staunch supporter of using branded search keywords (and those New York Jets).

So this column may throw you for a little bit of a loop. We’re talking about using ads to target brand searches – but only from those who don’t know the brand.

Hear me out.

I also thought the concept was illogical and went against industry best practices.

But there is a way to make it work and make it purposeful.

Interestingly, two separate clients in very different verticals approached me with a similar scenario:

- Client B: “How do we keep a brand presence, but not advertise to consumers who are already going to come to us?”

- Client N: “We want to see how first-time buyers on our brand name interact with us versus repeat buyers. But we want it as clean and clear as possible. How do we separate prior buyers on the brand name from people searching our name who haven’t bought before?”

Both essentially equate to in-market, brand-aware audiences, driven to look for us by a different form of media.

After I reminded them about the 1+1=3 SEO+SEM incrementality insights, I sat and tried to figure out how these Google Ads would work, what they would look like, and how to determine success.

Two Different Game Plans for Audience Lists

Since the requests were similar but different, we had to come up with a game plan to execute them. This would, in turn, influence the design.

To my surprise, this was actually simpler than expected.

Both clients are heavy users of Google Analytics (something I highly advocate for), making this design fairly effective.

First, I needed audience lists.

We created a list of all site visitors for Client B and made the range 365 days on it.

We used this list for exclusionary purposes, and the Google Similar Audience (i.e., Look a Like) generated would be for observation.

Image from Google Analytics, March 2022

Image from Google Analytics, March 2022Client N was slightly different. They had window shoppers but never buyers on their website, so we needed a somewhat less aggressive stance.

We created a list of anyone who made a minimum of one purchase on the website and used GA’s max range of 540 days.

We used this list as exclusionary.

This allowed prior visitors to come in still and get deals, providing they hadn’t purchased yet.

Image from Google Analytics, March 2022

Image from Google Analytics, March 2022Next, we had to wait.

We informed both clients the initial kick-off would take four to six weeks to allow the audience segments to build some history and be any degree of effectiveness.

We also supplemented these lists with CRM list uploads to bolster the accuracy where possible.

Eventually, we saw site visitors go from targeted to blocked or diverted, based on their behavior with the site.

Pro tip: Have a drawn-out timeline for deployment of anything that involves any first-party data audience lists. This allows the lists to grow and become more useful as time progresses.

How Do We Structure These Campaigns?

This isn’t rocket science (unlike trying to fold a fitted bed sheet).

In fact, there are different ways to do it. But I am for the most concrete separation of it, so I like to splinter things at the campaign level.

Client B is the easier structure – import audiences from GA into Google Ads.

Go into the campaigns and exclude the 365-day all visitor audience.

Boom, set to roll.

If you want to get fancy pants on this, add in the similar audience lists and in-market audiences you’ve vetted as observational.

Want to feel like an industry all-star? Add in a bid modifier.

But yeah, Client B is set.

Client N is slightly more complicated; they want to be visible on brand searches but to separate repeat buyers from non-buyers.

Monitor to track new customer growth, measure some branding efforts, and decide if you need incentives for non-buyers who know our name.

Note that there is a similar setup for non-brand, which already incentivizes new shoppers.

For Client N, we duplicated our brand keyword campaigns.

One for an exclusive audience target of the remarketing list of purchases in the past 540 days (plus a CRM list of confirmed purchases) will be called Repeat.

The other campaign excluded that remarketing list (and the CRM list); this campaign is called NTF (the internal naming acronym is all you need to know about why).

Over time, the 540-day list grows, so the non-buyer deals continue to go to those who have not purchased before.

In Client N, the two campaigns mirror each other in terms of bid keywords, bid strategy (not the most recommended approach), and landing page.

The primary difference between them (besides the audiences who see it) is that the creatives are slightly different.

![Are Brand Keywords Valuable For Every Audience? [Case Study]](https://cdn.searchenginejournal.com/wp-content/uploads/2022/03/3-march-2022-622e445a466f6-sej-480x153-1.png) Image from Google Analytics, March 2022

Image from Google Analytics, March 2022How Do We Determine Campaign Success?

To be honest, “success” in this scenario is a relative term.

Like starting my own small chicken farm in my back yard… in a city. There isn’t a clear but/defined line, but more of an observation of the audience.

For Client B, the concept of success was along the lines of capturing strong market share in our hyper-targeted geography of those who know our brand name but haven’t visited the site before.

Additionally, if we can get our conversions cost-effectively vs. that of all audiences, it would be a success.

Client N was different.

There was no true measurement of success.

There was just an observation of the value of a new customer vs. a repeat and seeing how they perform.

So like I said before, “success” here is relative.

In my eyes, for the record, my small flock chicken farm is successful.

Pro tip: Do not put your face near a chicken; they will bite you. They also do not enjoy wearing costumes. Both of those statements are directly correlated.

The Results:

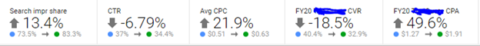

With Client B, it was quite interesting.

We said, “If you’ve been here before, we aren’t paying for you again!”

We measured the data from all audiences to just new visitors seven weeks before the change vs. seven weeks after the change (three-week differential between the two time frames to deal with holidays).

Image from Google Analytics, March 2022

Image from Google Analytics, March 2022Not surprisingly, CPC went up a bit, and CTR went down a bit; these are not end of the world differences.

Our conversion rate took a hit of 19%, and our cost per click (CPC) skyrocketed by 50%.

But when you look at the relative numbers, they aren’t as terrifying.

Given the low CPC of brand terms, our aggregate CPA goal was under $10, which we weren’t concerned about in this scenario.

What is important to note is, if market share is our primary success metric (translated over here as Impression Share), then we were “successful.”

Yes, our traffic dipped a bit (about 44%), but we captured more of the brand-aware, never visited our site audience.

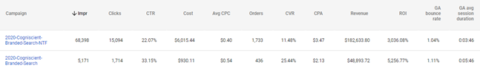

Client N remains different.

Once again, we wanted to understand the difference in behavior between the audiences and make it as clean and clear-cut as possible.

Image from Google Analytics, March 2022

Image from Google Analytics, March 2022The data was clear-cut and insightful.

We finally understood what non-search marketing was contributing to brand search demand.

It also showed us that repeat buys have a 7% higher average order value (AOV) and convert again at a conversion rate (CVR) of 220%+ higher than a first-time buyer on a brand term.

This also indicated a need to incentivize first-time buyers on brand terms, because of such a high chance of converting again on brand terms, and for more.

Essentially a repeat brand buyer, at a minimum (because our data is only eight months old), is worth 206% more in sales than a single buyer.

So, What Does This All Mean?

More or less, what you already suspected.

Being present on brand terms remains incredibly important.

But if you ever had to stray away from brand – at the very least, to save a few dollars – do not leave your first-time engagers.

They will get you into your CRM and help you show the value of non-search higher funnel marketing.

Also, chickens do bite.

More resources:

Featured Image: FOTOSPLASH/Shutterstock