Boost your skills with Growth Memo’s weekly expert insights. Subscribe for free!

Google’s launch and pullback of AI Overviews (AIOs) caught the most attention in the SEO scene over the last two months.

However, a change with at least the same significance flew under the radar: Google’s transformation from search engine to marketplace for shopping queries.

Yes, AIOs are impactful: In my initial analysis, I found a negative impact of -8.9% when a page cited in an AIO compared to ranking at the top of the classic web search results.

I then found that Google pulled 50-66% of AIOs back. However, Google shows a whole slew of SERP features and AI features for ecommerce queries that are at least as impactful as AIOs.

To better understand the key trends for shopping queries, I analyzed 35,305 keywords across categories like fashion, beds, plants, and automotive in the US over the last five months using SEOClarity.

The results:

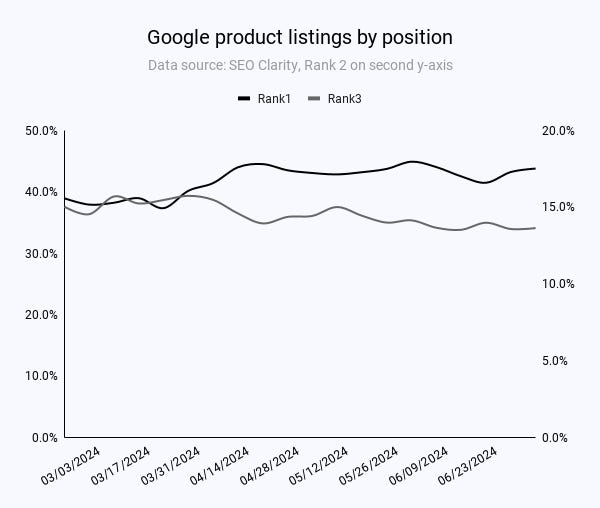

- Product listings appear more often in position 1 in June compared to February 2024.

- SERP features like Discussions & Forums gained visibility and opened a new playground for marketers.

- SERP features fluctuate in visibility and introduce a lot of noise in SEO metrics.

Google Shopping Marketplace

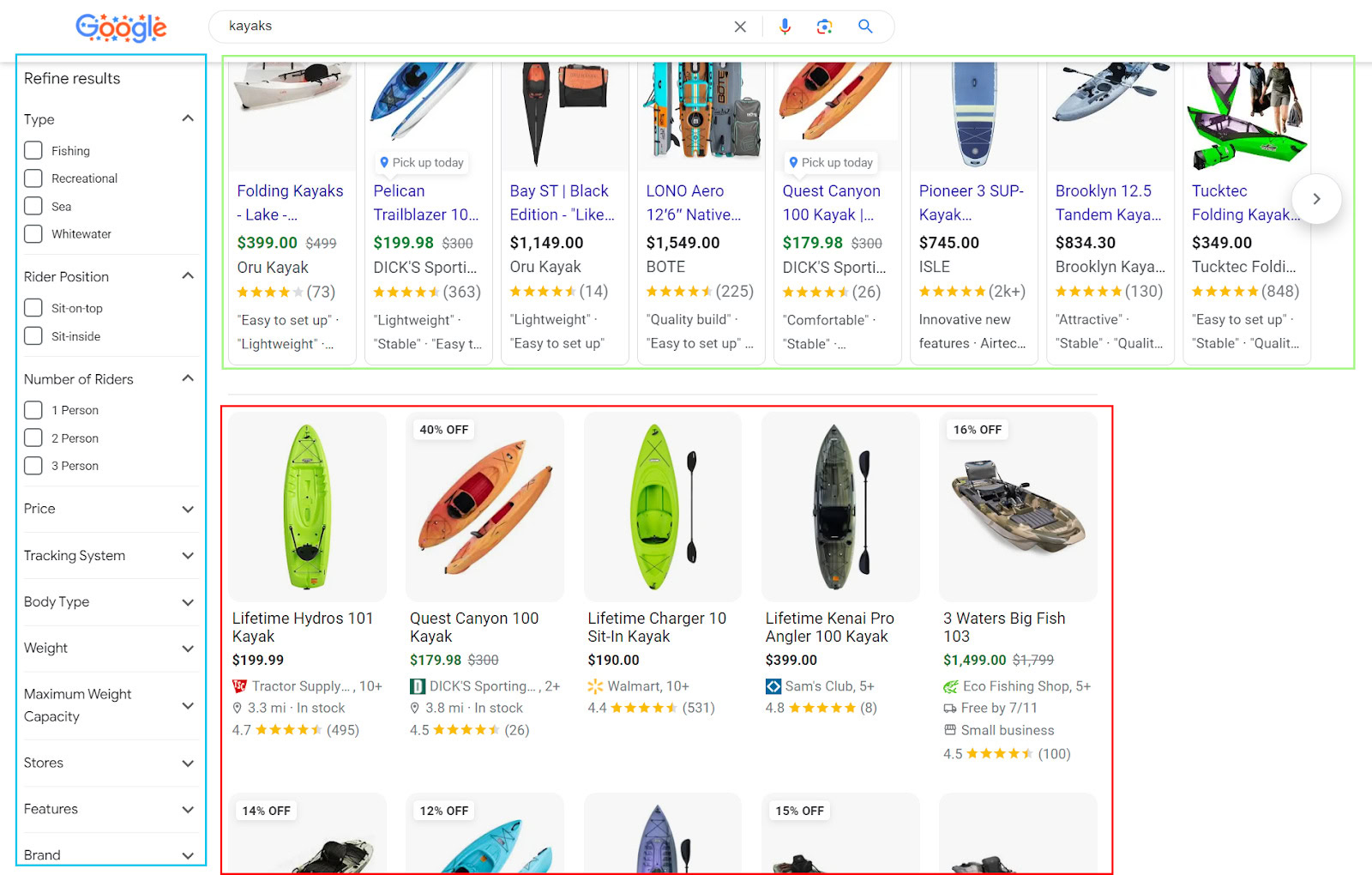

To summarize ecommerce shifts, where I explain Google’s shift from search engine to ecommerce marketplace, Google has merged the web results and shopping tab for shopping searches as a response to Amazon’s long-standing dominance:

- Google has fully transitioned into a shopping marketplace by adding product filters to search result pages and implementing a direct checkout option.

- These new features create an ecommerce search experience within Google Search and may significantly impact the organic traffic merchants and retailers rely on.

- Google has quietly introduced a direct checkout feature that allows merchants to link free listings directly to their checkout pages.

- Google’s move to a shopping marketplace was likely driven by the need to compete with Amazon’s successful advertising business.

- Google faces the challenge of balancing its role as a search engine with the need to generate revenue through its shopping marketplace, especially considering its dependence on partners for logistics.

To illustrate with an example:

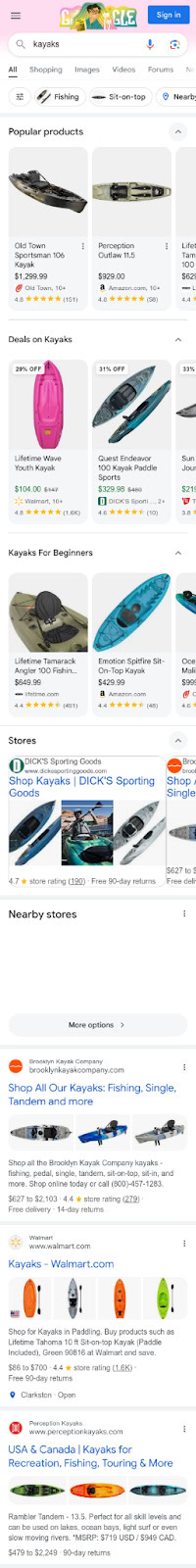

- Say you are looking for kayaks (summertime!).

- On desktop (logged-in), Google will now show you product filters on the left sidebar and product carousels in the middle on top of classic organic results – and ads, of course.

Image Credit: Kevin Indig

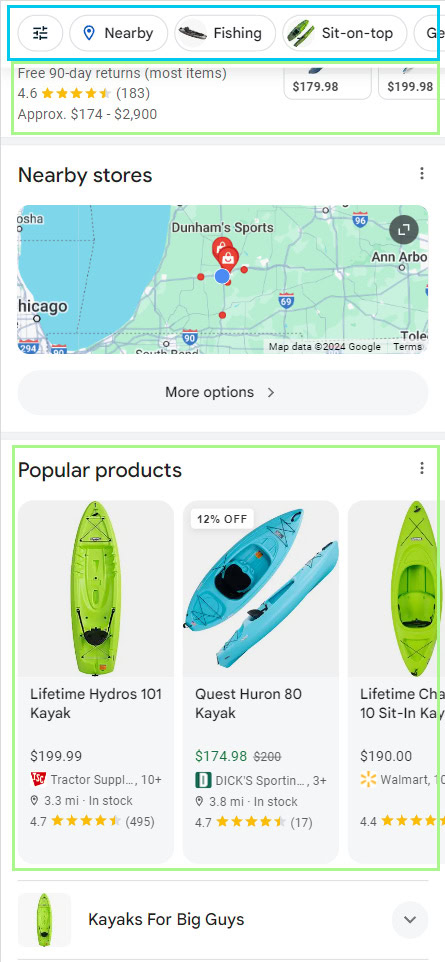

Image Credit: Kevin Indig- On mobile, you get product filters at the top, ads above organic results, and product carousels in the form of popular products.

Image Credit: Kevin Indig

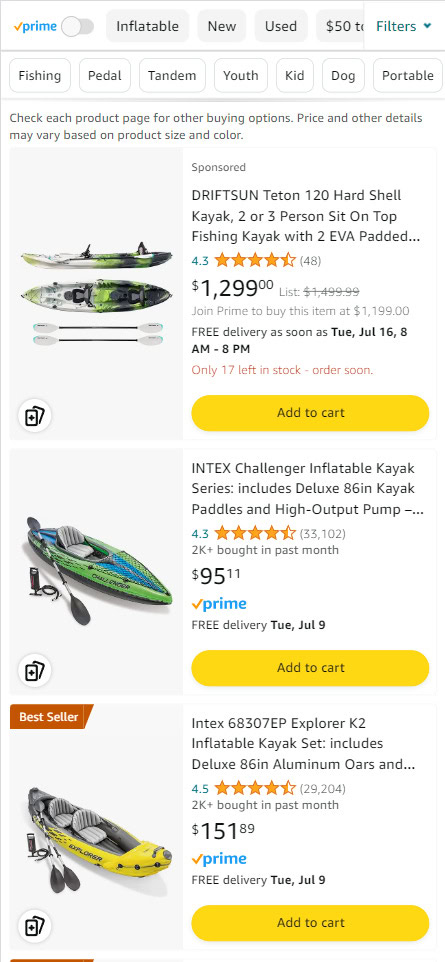

Image Credit: Kevin Indig- This experience doesn’t look very different from Amazon, which is the whole point.

Image Credit: Kevin Indig

Image Credit: Kevin IndigGoogle’s new shopping experience lets users explore products on Amazon, Walmart, Ebay, Esty, & Co.

From an SEO perspective, the prominent position of product grid (listings) and filters likely significantly impacts CTR, organic traffic, and, ultimately, revenue.

Product Listings Appear More Often In Position 1

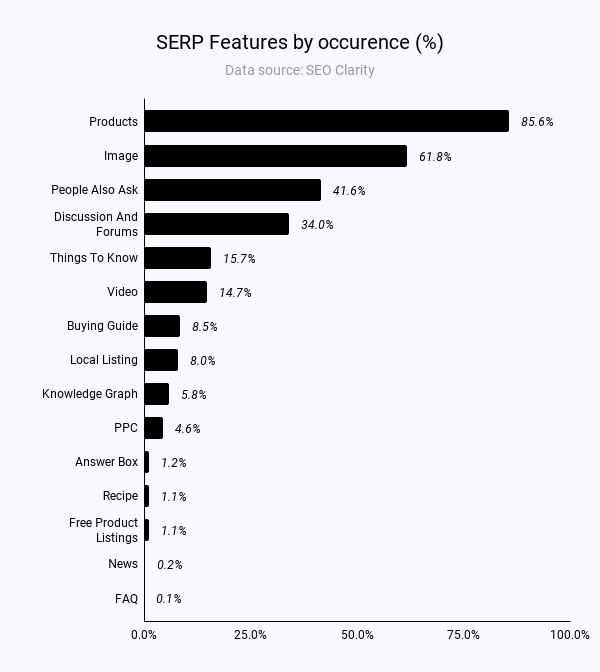

30,172 out of 35,305 keywords (85.6%) show product listings, which are the free product carousels, in my analysis. It’s the most visible SERP feature in shopping search.

In February, product listings showed up for 39% of queries in position 1 and 15% of queries in position 3.

In July, that number shifted to 43% for position 1 and 13.6% for position 3. Google moved product listings higher up the SERPs.

Image Credit: Kevin Indig

Image Credit: Kevin IndigThe shift from web links to product images makes product listings a cornerstone feature in Google’s transformation. The increased visibility means Google doubles down on the new model.

Discussions & Forums Gain Visibility

After product listings (85.6% of queries), image carousels (61.8% of queries) are the most common SERP features.

Image Credit: Kevin Indig

Image Credit: Kevin IndigImage carousels are highly impactful because shopping is a visual act. Seeing the right product can very quickly trigger a purchase, as opposed to customers being stuck in the Messy Middle for longer.

Retailers and ecommerce brands put a lot of effort into high-quality product pictures and need to spend equal time optimizing images for Google Search, even though organic traffic is usually much lower than web ranks.

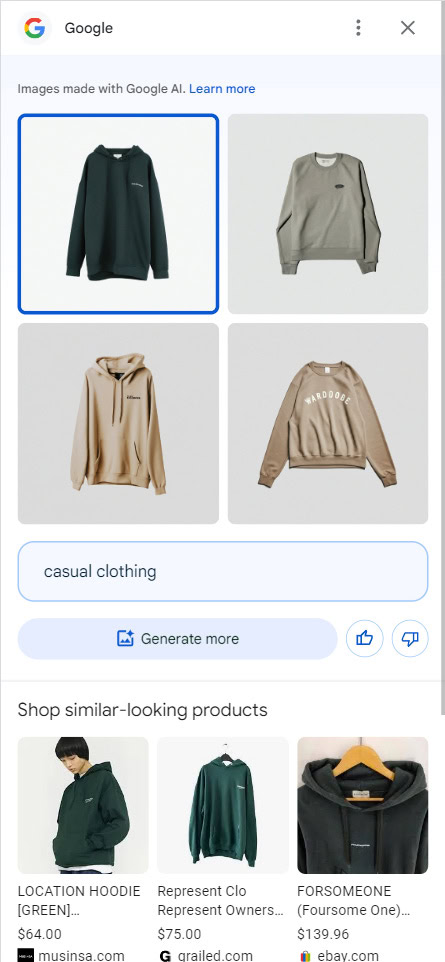

Google now tests “generate image with AI,” a feature that lets users generate product images with prompts and then see similar (real) products.

It’s a powerful application of AI that, again, flies under the AIO radar but could also be impactful by making it easier for users to find things they want.

Image Credit: Kevin Indig

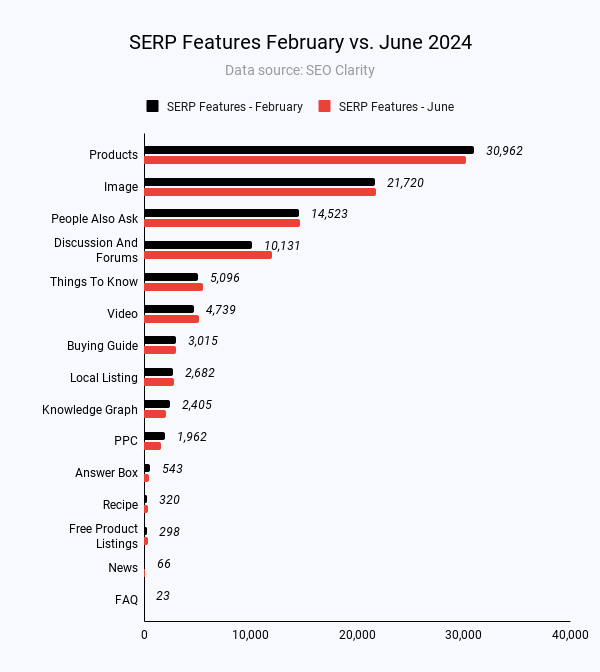

Image Credit: Kevin IndigVisibility for most SERP features remained relatively unchanged between February and July, with one exception: Discussions & Forums grew from 28.7% to 34% of all queries (+5.3 percentage points).

Image Credit: Kevin Indig

Image Credit: Kevin IndigThe change in Discussions & Forums SERP features is in line with Reddit’s unprecedented SEO visibility gain over the last 12 months. The domain now operates at the traffic level of Facebook and Amazon.

Google’s Discussions & Forums feature highlights threads in forums like Reddit, Quora, and others. People visit forums when they are looking for authentic and unincentivized opinions from other consumers. Many review articles are biased, and it seems consumers know.

As a result, Google compensates for lower review quality with more user-generated content from forums. In Free Content, I referenced a study from Germany titled “Is Google getting worse?” that found:

- “An overall downward trend in text quality in all three search engines.”

- “Higher-ranked pages are on average more optimized, more monetized with affiliate marketing, and they show signs of lower text quality.”

Discussions & Forums show that high visibility doesn’t equal high impact for SERP features.

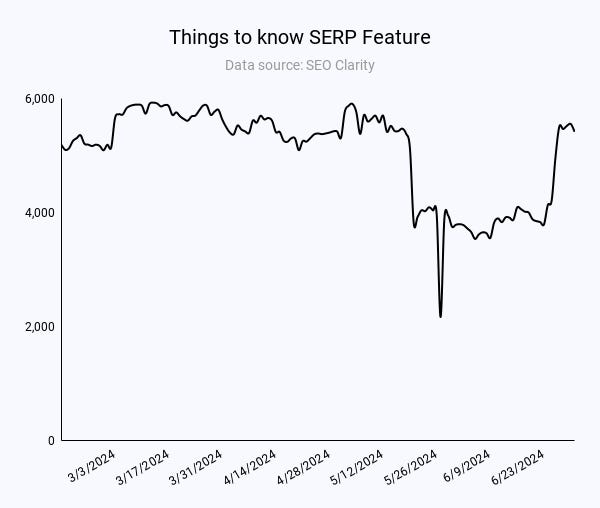

SERP Features And Their Impact Fluctuate

SERP features are commonly assumed to show up at a stable rate in Search, but Google constantly tests them.

As a result, SERP features that impact click-through rates can introduce a lot of noise into common SEO data (CTR, clicks, even revenue).

At the same time, Google switching some features on and off can help SEO pros understand the impact of SERP features on SEO metrics.

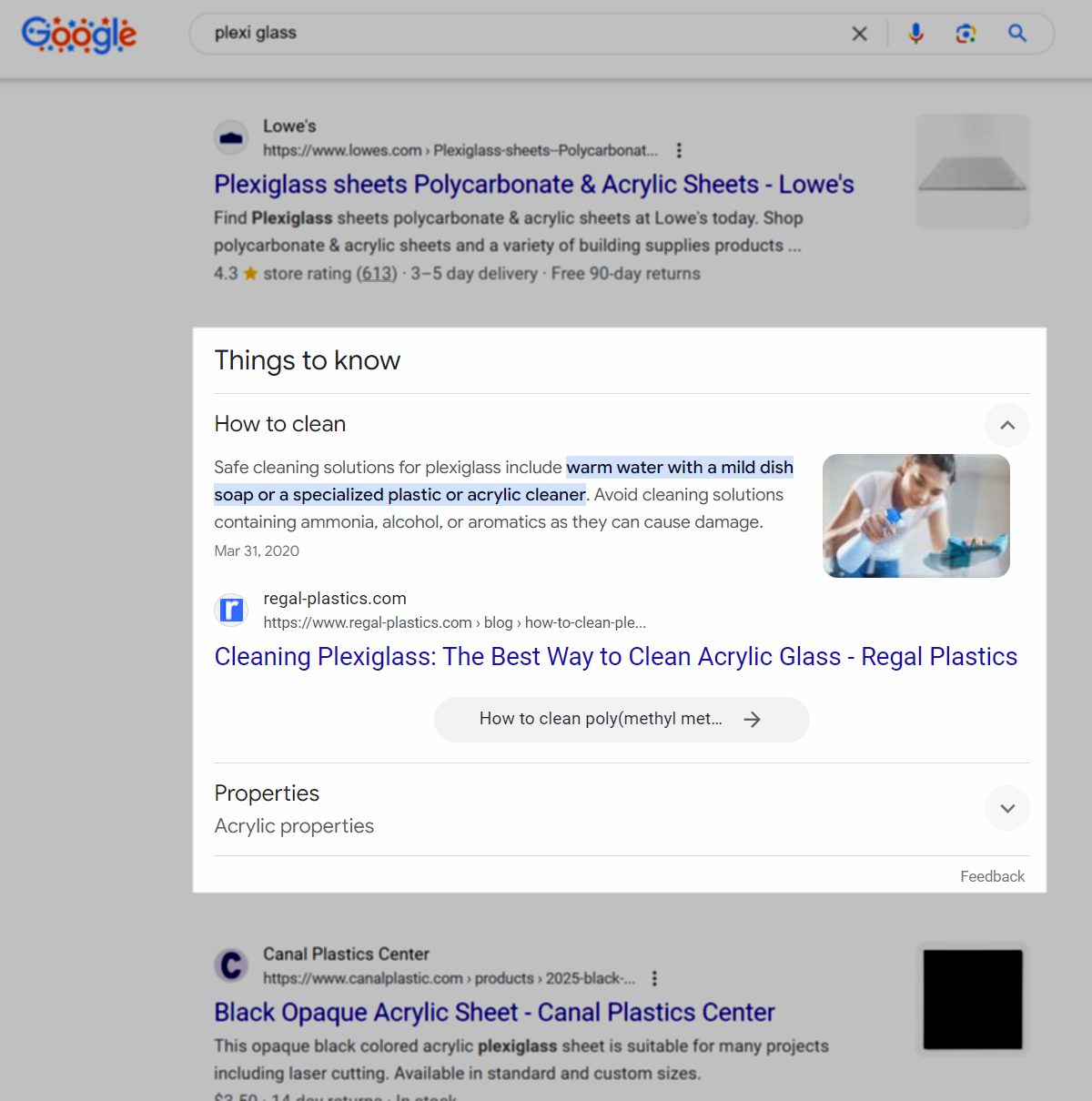

A good example is the Things To Know feature (TTK), which answers two common questions about a product with links to websites.

Image Credit: Kevin Indig

Image Credit: Kevin IndigAfter months of stable visibility, Google suddenly reduced the number of TTKs by -37.5% for a month, bringing it back to previous levels.

Sites that were linked in TTK might have seen less organic traffic during that month. Since TTK isn’t reported in Search Console, those sites might wonder why their organic traffic dropped even though ranks might be stable.

Image Credit: Kevin Indig

Image Credit: Kevin IndigComing back to the Kayak example from earlier, Google tests variations like deals and carousel segments (“Kayaks For Beginners”).

Image Credit: Kevin Indig

Image Credit: Kevin IndigYou can imagine how hard this makes getting stable data and why it’s so critical to monitor SERP features.

Featured Image: Paulo Bobita/Search Engine Journal